Here a list of the best credit cards for the people in India whose salary lies between 3 to 5 lakhs per annum and can able to spend between 1 lakh to 2 lakh per year on a credit card.

Here at 2023 those credit cards where you get a minimum of 5% cashback on specific transactions and a minimum of 1% cashback on all other expenses. You can apply for 2 different credit cards to combine two unique special offerings to get the best value.

As an example,

SBI cashback credit card for online spending and an Axis Ace credit card for utility bill payments to earn 5% cashback on both categories.

ONE OF THE BEST CARD FOR

ONE OF THE BEST CARD FOR

ONLINE SHOPPING

BILL PAYMENT

REFUELING

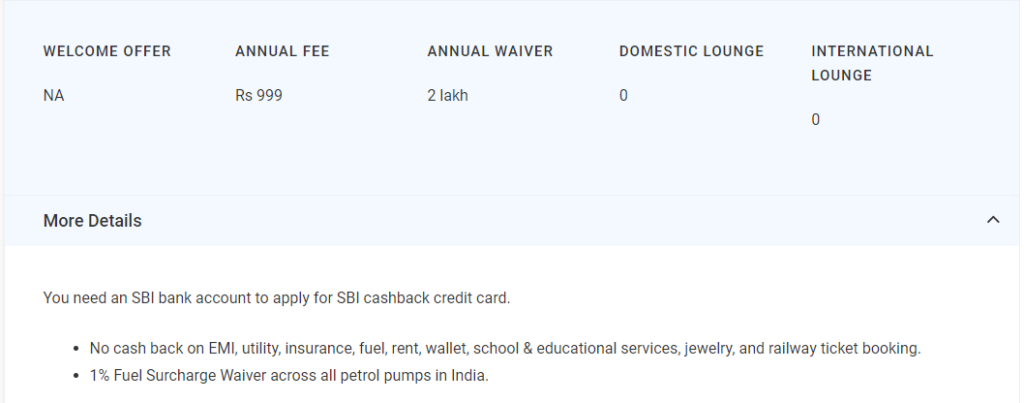

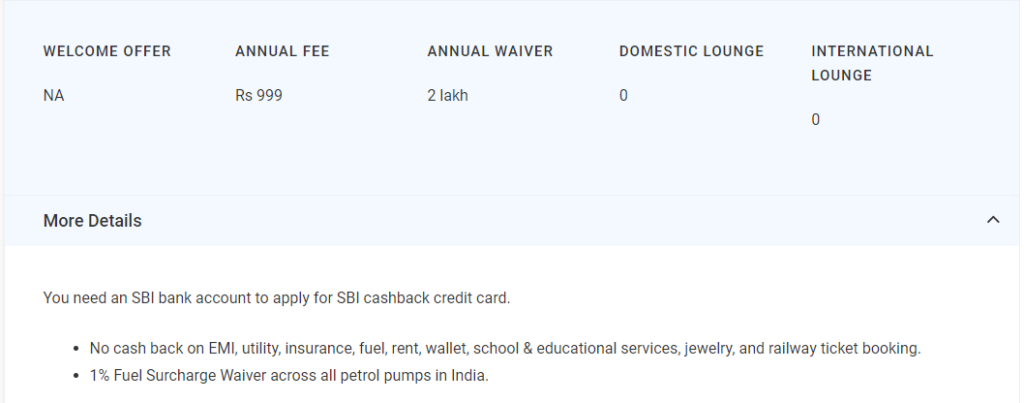

SBI Cashback is one of the best credit cards for online spending. You get 5% cash back on all your online purchases without any specific website restriction.

If you have an SBI cashback credit card you wouldn’t need ICICI Amazon pay, and Axis Flipkart and.

You get 1% cashback on all offline spending.

BEST CREDIT CARD FOR UTILITY PAYMENT

BEST CREDIT CARD FOR UTILITY PAYMENT

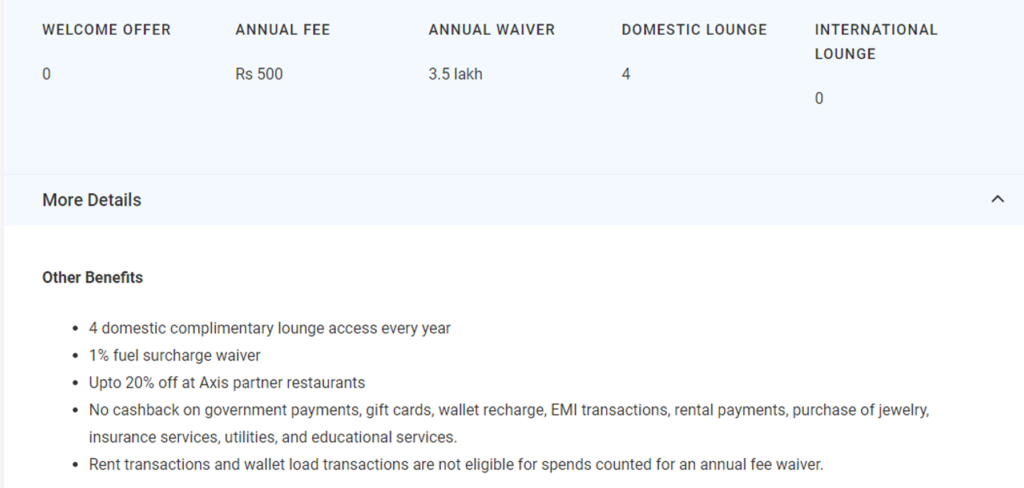

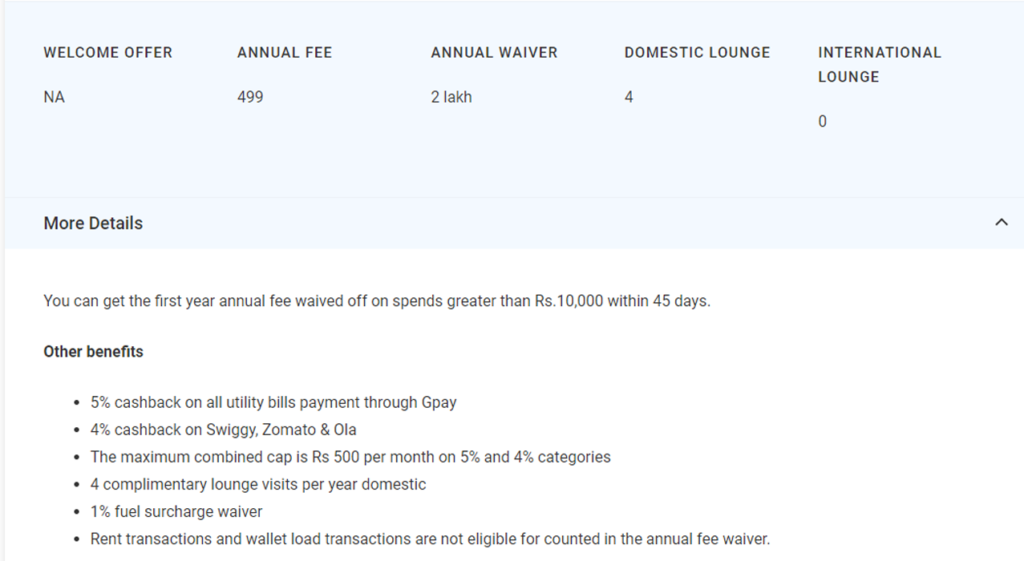

AXIS ACE CREDIT CARD

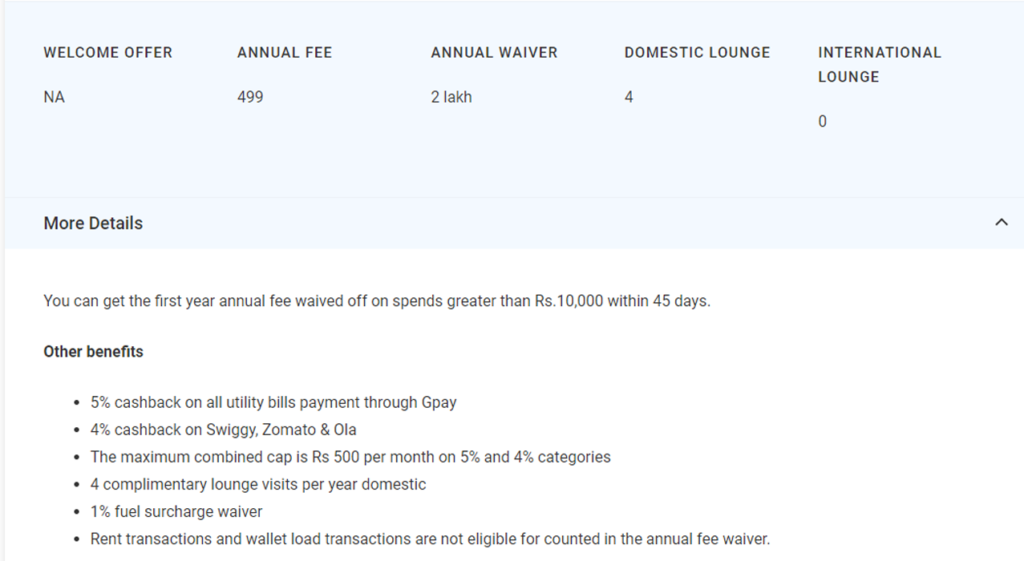

You will get 5% cashback on all utility bills payment using Ace card on Gpay.

You get 2% cashback on all other transactions without any limit which is the best among the beginner-level credit cards.

Keep Axis Ace credit card along with an SBI cashback credit card to make best combo of 5% cashback on Online Shopping and Utility Payments.

FOR ONLINE SHOPPING & AIRPORT LOUNGE

FOR ONLINE SHOPPING & AIRPORT LOUNGE

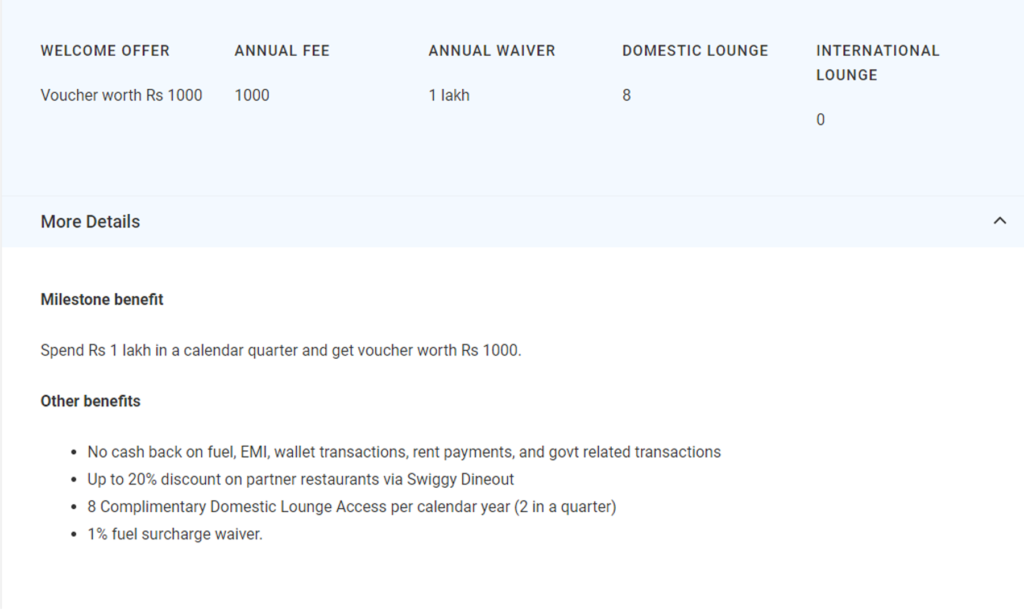

HDFC MILLENNIA CREDIT CARD

HDFC Millennia credit card provides 5% cashback on selected merchants like Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato.

You get 1% cashback on all other spends equivalent to SBI cashback.

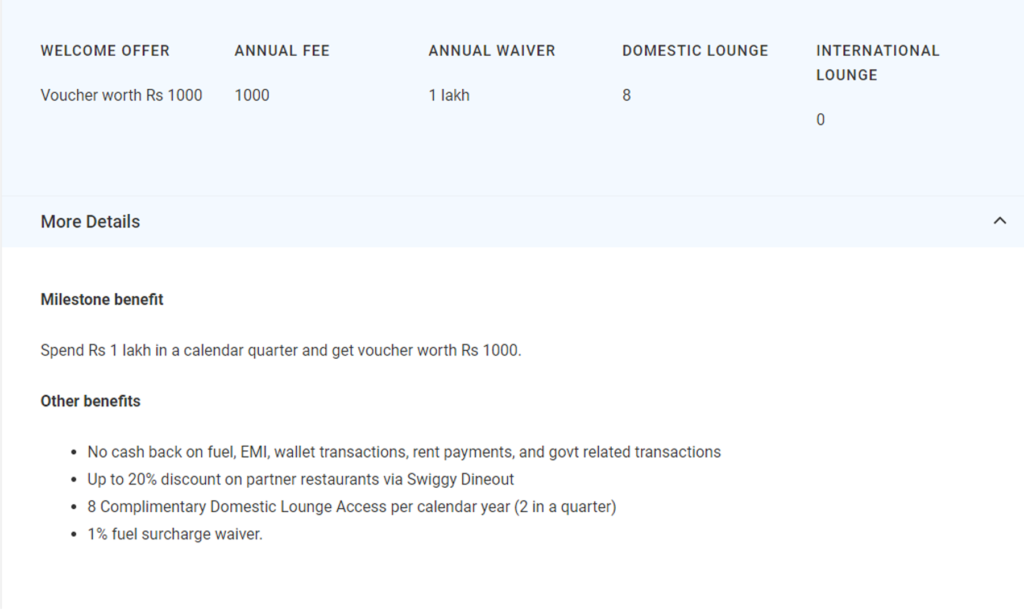

You get 8 complimentary domestic lounge access per calendar year which is not available in the SBI cashback credit card.

LIFETIME FREE

LIFETIME FREE

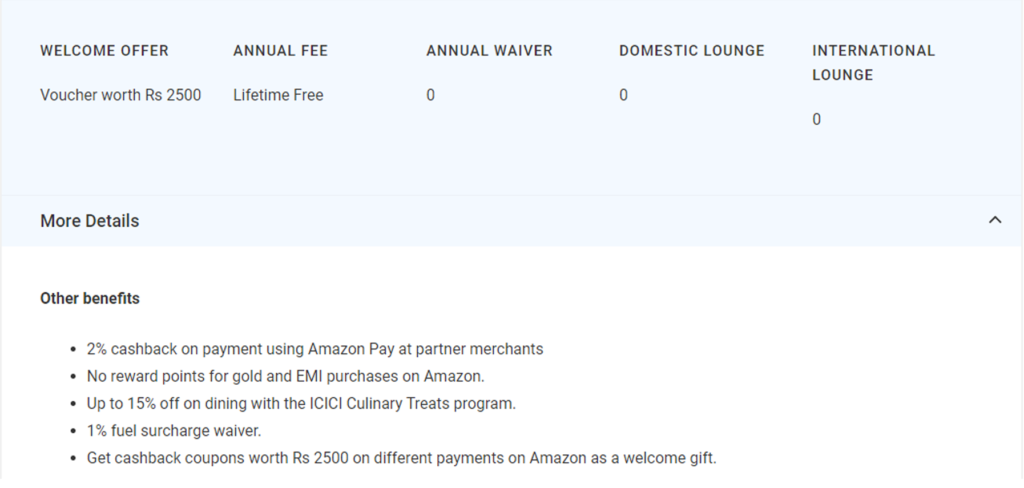

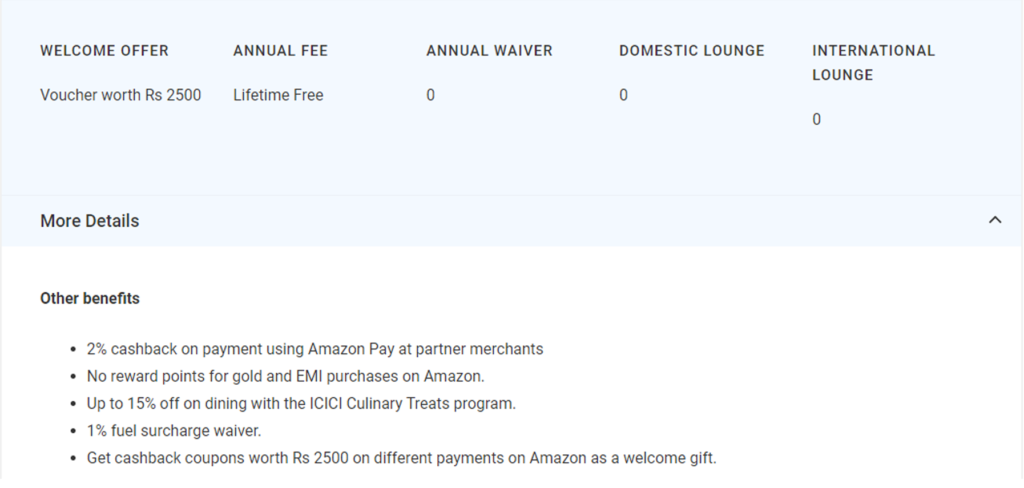

ICICI AMAZON PAY CREDIT CARD

Amazon Pay ICICI credit card provides 5% cashback to Prime members and 3% to non-prime members on Amazon shopping.

You will get 1% on all other online and offline spending.

BEST FOR FLIPKART SHOPPING

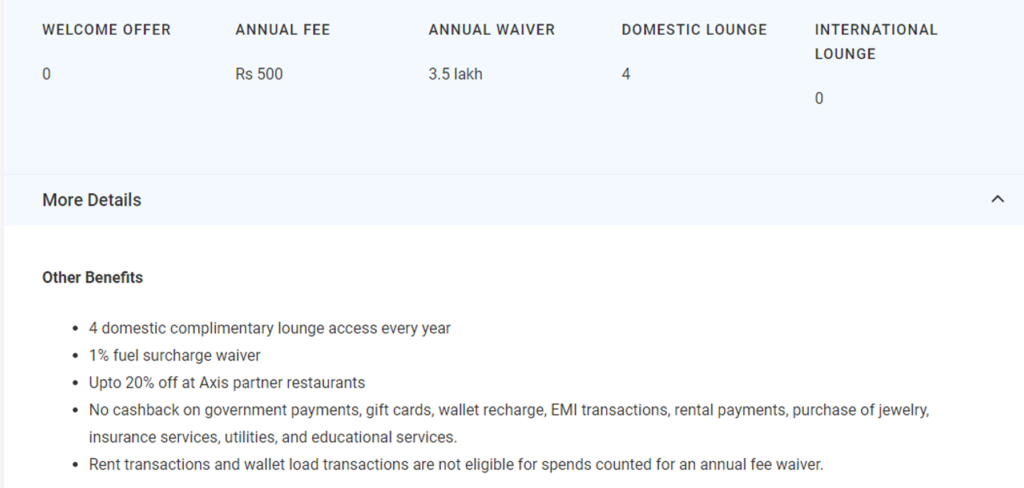

AXIS FLIPKART CREDIT CARD

Axis Flipkart credit card gives you 5% cash back on all your Flipkart spending except for hotel & flight bookings.

You get 1.5% cash back on all your transactions which is the second best after the Axis Ace credit card from this list.

ONE OF THE BEST CARD FOR

ONE OF THE BEST CARD FOR

BEST CREDIT CARD FOR UTILITY PAYMENT

BEST CREDIT CARD FOR UTILITY PAYMENT

FOR ONLINE SHOPPING & AIRPORT LOUNGE

FOR ONLINE SHOPPING & AIRPORT LOUNGE

LIFETIME FREE

LIFETIME FREE